About Corpay

The smarter corporate payments company

Providing a modern day, smarter way to simplify how you make payments

Who we are

Corpay is a global S&P500 corporate payments company that helps businesses and consumers pay expenses in a simple, controlled manner.

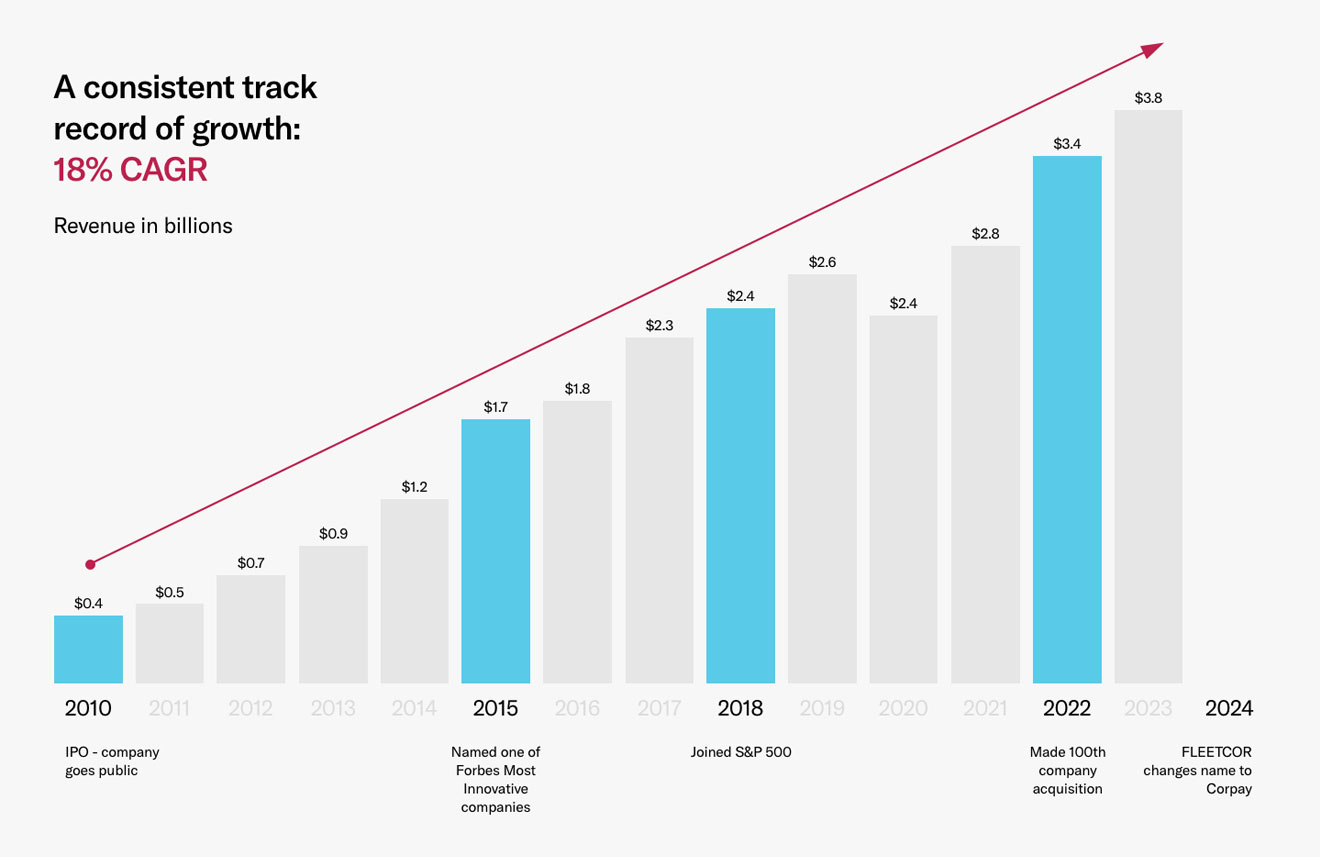

$3.8B

Revenue (2023)

S&P 500

Member company

NYSE: CPAY

Publicly traded company

800,000+

Business clients

$1.3B

Adjusted net income (2023)

Company growth and milestones

What we do

Corporate Payments

Simplify how businesses pay other businesses

• AP automation

• Commercial cards

• Cross-Border payments

Vehicle Payments

Simplify how drivers pay for vehicle-related expenses

• Fuel & electric vehicle (EV) charging

• Parking

• Auto insurance

• Tolls

• Maintenance/service

Lodging Payments

Simplify how businesses book and pay for workforce lodging

• Managed lodging program

• Airline passengers and crews

How we help

Reduce costs

Save time and money using our automated processes, proprietary payment networks, and integrated platforms.

Customize controls

Reduce fraud, unauthorized spending, and processing errors through specialized controls and permissions.

Simplify processes

Increase efficiency and accuracy with digital payment processes that automate data inputs and workflows.

Apply insights

Make smarter business decisions with reporting, analysis, and insights on all your business spend.